Marie Kondo and Your Finances

I love watching TV. I watch Bloomberg in the mornings and I usually cue up a show from Netflix or Amazon Prime after the kids are asleep, to help me unwind.One of my favorite new shows is “Tidying Up with Marie Kondo.” Watching her organize other people’s lives makes me feel calmer. I’ve even gotten into folding clothes the way she does to keep my drawers and closets organized.So, what does this have to do with investing?One of the themes she repeats in each episode is to be willing to part with items you don’t love, and to only keep things that “spark joy.”In that spirit, I recently went through our kitchen drawers (shudder) with the goal of getting rid of any kitchen utensils we’ve accumulated over the years but never use.

- Rolling pin – gone. We are not pizza makers.

- 4th spatula – gone. We’ve got a dishwasher for the other three.

- Backup salad tongs – gone. We haven’t made a salad that requires tossing since 2013.

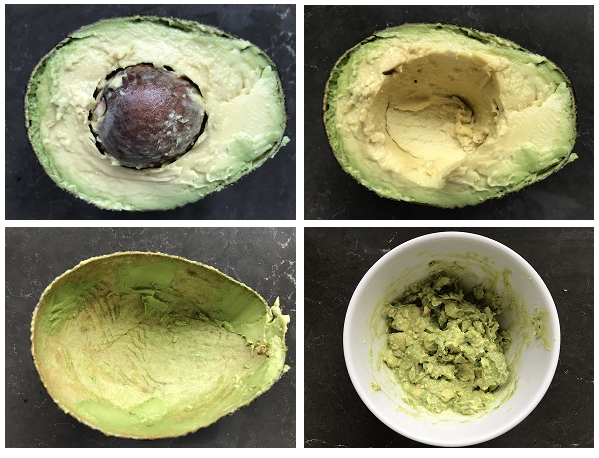

In this liquidation process, I came across a weird instrument I must have glanced over a thousand times but never used: An avocado tool. “Are you kidding,” I thought to myself at first. “An avocado tool? How efficiently do we really need to be pitting our avocados?”But at that exact moment, I noticed we had a perfectly ripe avocado in the fruit bowl, right in front of me. And I was hungry. And we had some chips.So I decided to test this thing out, to see if it sparked enough joy to survive my kitchen purge.Well, I’ll tell you what. It not only made pitting that avocado less of a pain than it normally is when I use a spoon or a knife; it actually made pitting the avocado… a pure delight.I think there are two reasons for this. First, I got all of the avocado out of the skin, off the pit and into a bowl in about 30 seconds.

“Are you kidding,” I thought to myself at first. “An avocado tool? How efficiently do we really need to be pitting our avocados?”But at that exact moment, I noticed we had a perfectly ripe avocado in the fruit bowl, right in front of me. And I was hungry. And we had some chips.So I decided to test this thing out, to see if it sparked enough joy to survive my kitchen purge.Well, I’ll tell you what. It not only made pitting that avocado less of a pain than it normally is when I use a spoon or a knife; it actually made pitting the avocado… a pure delight.I think there are two reasons for this. First, I got all of the avocado out of the skin, off the pit and into a bowl in about 30 seconds. No wasted avocado flesh stuck to the pit or on the skin, no frustration trying to scoop the pit out with a knife or shooting it across the room with a spoon. But there was another reason why the avocado tool made this task so enjoyable:It was the perfect tool for the job, and I already had it. Right there.This reminded me of a financial tool that I routinely recommend to clients, some of whom already have it but don’t think to use it:Their Home Equity Line of Credit (HELOC).The HELOC is a wonderful tool and a huge bonus for home-owners. It allows you to borrow money against the value of your home at rates that are often much lower than those offered for other types of loans.A HELOC is great for a variety of purposes. I’ve recommended it to clients for:

No wasted avocado flesh stuck to the pit or on the skin, no frustration trying to scoop the pit out with a knife or shooting it across the room with a spoon. But there was another reason why the avocado tool made this task so enjoyable:It was the perfect tool for the job, and I already had it. Right there.This reminded me of a financial tool that I routinely recommend to clients, some of whom already have it but don’t think to use it:Their Home Equity Line of Credit (HELOC).The HELOC is a wonderful tool and a huge bonus for home-owners. It allows you to borrow money against the value of your home at rates that are often much lower than those offered for other types of loans.A HELOC is great for a variety of purposes. I’ve recommended it to clients for:

- Starting a small business;

- A home renovation or addition;

- Funding an extended job search or career change;

- An emergency or rainy-day fund.

I would discourage using it for other purposes such as vacations, increased spending, or general consumption.To qualify for a HELOC, you need to have:

- A steady income;

- A good credit score;

- At least 20% equity in your house (in Texas -- some other states require only 15%).

A HELOC is basically just a great way to get a loan at rates that are much lower than most credit cards.

And that seems like it could spark some serious joy.

***

If you haven’t seen Marie Kondo’s show yet, you can get a sense of her calming presence in this 2-minute video.