Investment Strategies: The Diversified Portfolio

If there was a class called Toddlers 101, lesson number one would be called Choices: Which One Would You Rather Have?“Judy, do you want to wear the red shirt or the blue shirt?” In addition to being empowered to make hard choices, the kiddo figures out that wearing two shirts at the same time is not really an option.In the investing classes I teach, we spend a lot of time talking about the hard choices that investors must make. Do you want growth, or do you want safety?The truth is, there’s no magic investing strategy that delivers high growth and no downside.It’s a package deal: If you want high growth, you’ll need to take more risk. If your top priority is not losing money, you can’t expect big gains from your investments.The trick for most investors is to strategically balance growth and risk over the long term.

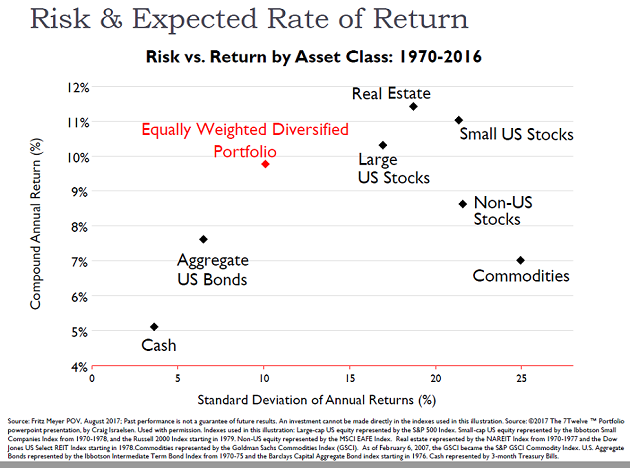

Diversification Strategy: Balancing Risk vs. Expected Return

The following graph shows data from 1970-2016 on the seven major asset classes, each marked by a black diamond. The vertical axis shows the long-term returns for each asset class (“Compound Annual Returns”) and the horizontal axis shows the degree of volatility/risk (“Standard Deviation of Annual Returns”).  From 1970-1946, the highest average annual returns came from commercial real estate (11.4%), small US stocks (11%), large US stocks (10.3%) and non-US stocks (8.7%).However, those high returns came with a big dose of risk and volatility. The high return assets are clustered on the right side of the graph, meaning that while the average returns over 46 years were high, the yearly returns bounced around a lot. There were big gains in some years and big losses in others.In the bottom left corner we have our turtles, slow and steady. US bonds and cash may not have been the biggest returners over this period, but they were more predictable.Every investor wants to be in the “golden corner,” up and to the left. High returns, low risk. But as you can see, that corner is empty.The red diamond shows a good balance for most investors: a diversified portfolio that uses low-risk assets for stability and higher-risk assets for growth. The red diamond is a hypothetical portfolio where the seven asset classes each make up 14% of the portfolio. Thanks to Modern Portfolio Theory, this equally-weighted portfolio was able to deliver most of the growth of the highest returning asset classes, but with a lot less risk.

From 1970-1946, the highest average annual returns came from commercial real estate (11.4%), small US stocks (11%), large US stocks (10.3%) and non-US stocks (8.7%).However, those high returns came with a big dose of risk and volatility. The high return assets are clustered on the right side of the graph, meaning that while the average returns over 46 years were high, the yearly returns bounced around a lot. There were big gains in some years and big losses in others.In the bottom left corner we have our turtles, slow and steady. US bonds and cash may not have been the biggest returners over this period, but they were more predictable.Every investor wants to be in the “golden corner,” up and to the left. High returns, low risk. But as you can see, that corner is empty.The red diamond shows a good balance for most investors: a diversified portfolio that uses low-risk assets for stability and higher-risk assets for growth. The red diamond is a hypothetical portfolio where the seven asset classes each make up 14% of the portfolio. Thanks to Modern Portfolio Theory, this equally-weighted portfolio was able to deliver most of the growth of the highest returning asset classes, but with a lot less risk.

Timing: Dial-Down Risk as Retirement Approaches

Just as important as a general diversification strategy is how you manage that balance of high- and low-risk assets over time. If you’re invested in stocks when the market declines, the last thing you want to do is sell while stocks are way down.Keep in mind that starting in 2007, the stock market fell by over 50% and it took 64 months to get back to where it started. That’s almost five and a half years. A good planning exercise is to think about money you might need in the next five years (60 months of living expenses if you’re retired, college tuition for older kids, a down payment on a house) and DON’T invest that money in the stock market.If you have 10+ years before you might need to withdraw the money, then that portion of your portfolio is a great candidate for growth assets like stocks (investing sooner rather than later is almost always the best choice.)