What is an ETF? The Simple Way to Get into Stocks

I talk to a lot of folks who are just beginning to learn about investing. One thing I notice is how many people wait to start investing because they’re worried about doing it wrong.People get bogged down with questions that professional market analysts have difficulty answering: What stocks should I buy? When is the best time to buy them? How do I find the next big thing? What if I buy a stock today and the company tanks tomorrow? What about Trump?With no easy answers to these questions, some would-be investors sit on the sidelines indefinitely, missing out on the opportunity to grow their wealth. If that sounds like you, here's a tip that might get you over the hump and into the markets.If you're willing to give up the dream of making an 8,000% return on your money by finding "the next Amazon", and if you can leave your money in this investment for the long term (15+ years), you can minimize your risk and match the overall gains of the market with an Exchange Traded Fund (ETF).

Index Funds and ETFs

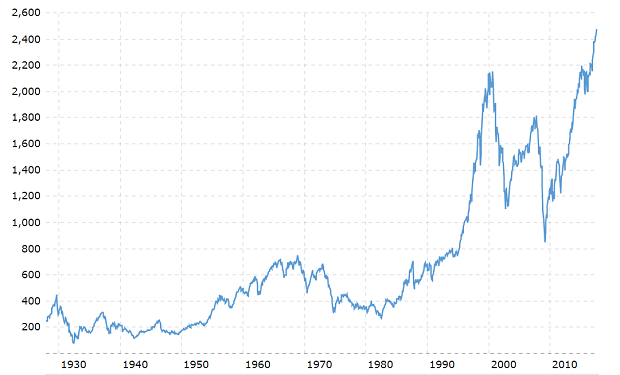

Ever seen a chart of the Dow Jones Industrial Average (DJIA)? Or the S&P 500? This one shows the S&P going back to 1927, adjusted for inflation:  Source: MacrotrendsThe Dow and the S&P 500 are both market “indexes”, meaning they each take a bunch of individual stocks and measure the collective performance of the whole group. Do you want to know something that blew my mind the first time I heard it? For being such an important metric, the Dow only has 30 stocks in it. (The S&P has – you guessed it – 500).The chart above shows what you probably already know: there are times when the stock market dips (and sometimes it takes years for it to recover), but historically, it goes up over the long run.An ETF is a simple, reasonably safe way for you to reap those long-term market gains. Think of it like a basket of stocks. If you buy an ETF, you basically own tiny slivers of all the stocks in the basket. An ETF that tracks the S&P 500 owns some or all of the 500 stocks in that index. The Vanguard 500 Index ETF (ticker symbol VOO) is a great example.If you’re willing to leave your money in an S&P 500 ETF for the long haul, this is a great way to get your foot in the door of investing. Your ETF will go up and down with the broad stock market, and you’ll mitigate your risk of an Enron-type event because there are 499 other companies in the basket. (I don't typically recommend Dow ETFs because there are only 30 companies in the index.)Is there still risk? Absolutely. An S&P 500 ETF can easily go down 25% or more in a year. Could you lose all your money? It’s possible. But only if all 500 companies in the S&P fail at the same time, which is highly unlikely.So if you’re looking to get into stocks, but you don’t have the time to research hundreds of different companies, an S&P 500 ETF is a great way to go.

Source: MacrotrendsThe Dow and the S&P 500 are both market “indexes”, meaning they each take a bunch of individual stocks and measure the collective performance of the whole group. Do you want to know something that blew my mind the first time I heard it? For being such an important metric, the Dow only has 30 stocks in it. (The S&P has – you guessed it – 500).The chart above shows what you probably already know: there are times when the stock market dips (and sometimes it takes years for it to recover), but historically, it goes up over the long run.An ETF is a simple, reasonably safe way for you to reap those long-term market gains. Think of it like a basket of stocks. If you buy an ETF, you basically own tiny slivers of all the stocks in the basket. An ETF that tracks the S&P 500 owns some or all of the 500 stocks in that index. The Vanguard 500 Index ETF (ticker symbol VOO) is a great example.If you’re willing to leave your money in an S&P 500 ETF for the long haul, this is a great way to get your foot in the door of investing. Your ETF will go up and down with the broad stock market, and you’ll mitigate your risk of an Enron-type event because there are 499 other companies in the basket. (I don't typically recommend Dow ETFs because there are only 30 companies in the index.)Is there still risk? Absolutely. An S&P 500 ETF can easily go down 25% or more in a year. Could you lose all your money? It’s possible. But only if all 500 companies in the S&P fail at the same time, which is highly unlikely.So if you’re looking to get into stocks, but you don’t have the time to research hundreds of different companies, an S&P 500 ETF is a great way to go.